Find the right solution for all your

financial needs

Trusted by Thousands

Our Products

Choose the right financial support for your needs — whether it's for personal growth or business expansion, we've got you covered.

Personal Loan

Flexible personal loans for life's milestones and unexpected needs — quick, simple, and secure.

Business Loan

Smart funding solutions designed to power your business growth and expansion with ease.

Why Choose Infinz

Your trusted partner for smart borrowing decisions with India's most comprehensive loan marketplace

Multiple Offers from Top NBFCs & Banks

Compare loan offers from over 50+ leading NBFCs and banks, including HDFC, ICICI, Bajaj Finserv, and more.

Faster Approval

Get instant pre-approval within 2 minutes with our streamlined digital assessment.

Quick Disbursal

Receive funds within 24 hours after final approval. Our direct partnerships with lenders ensure seamless processing.

Lower Interest Rates

Save thousands with our competitive interest rates starting from 10.49% per annum.

Flexible Repayment

Choose repayment tenures from 6 months to 7 years based on your comfort and cash flow.

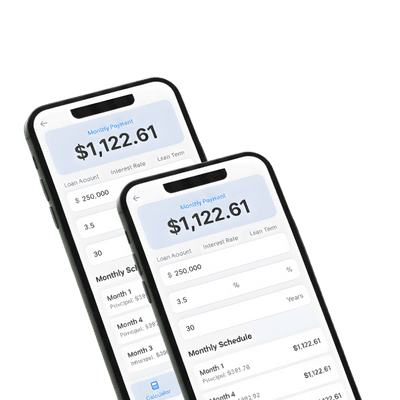

Check Your EMI Now

Quickly calculate your EMI and plan your payments with ease — smart, simple, and accurate.

Get a Loan Online in 5 Simple Steps

Experience the fastest and most convenient way to secure your loan with our streamlined digital process that puts you in control

Verify Mobile Number

Instant mobile authentication to protect your application

Enter Basic Details

Share basic personal and professional information quickly

Fill-up Loan Requirement

Select your loan amount, tenure, and purpose from our flexible options

Complete KYC

Upload documents digitally for instant verification and compliance

Get Your Loan

Receive funds directly in your bank account within 24 hours of approval

⚡ Get approved in minutes • 🔒 100% secure process • 💰 Competitive rates

Our Trusted Lenders

Partner with India's leading financial institutions for the best loan rates and seamless approval process

HDFC Bank

Trusted Partner

ICICI Bank

Trusted Partner

Axis Bank

Trusted Partner

Bajaj Finserv

Trusted Partner

Kotak Bank

Trusted Partner

SBI Bank

Trusted Partner

YES Bank

Trusted Partner

IndusInd Bank

Trusted Partner

IDFC First

Trusted Partner

Tata Capital

Trusted Partner

HDFC Bank

Trusted Partner

ICICI Bank

Trusted Partner

Axis Bank

Trusted Partner

Bajaj Finserv

Trusted Partner

Kotak Bank

Trusted Partner

SBI Bank

Trusted Partner

YES Bank

Trusted Partner

IndusInd Bank

Trusted Partner

IDFC First

Trusted Partner

Tata Capital

Trusted Partner

HDFC Bank

Trusted Partner

ICICI Bank

Trusted Partner

Axis Bank

Trusted Partner

Bajaj Finserv

Trusted Partner

Kotak Bank

Trusted Partner

SBI Bank

Trusted Partner

YES Bank

Trusted Partner

IndusInd Bank

Trusted Partner

IDFC First

Trusted Partner

Tata Capital

Trusted Partner

What Our Customers Say

Real people, real savings. See how Infinz helped our customers find better loan deals and achieve their financial goals

Frequently Asked Questions?

Instant loan designed to help you with immediate expenses, and provides quick access to funds through an online application process. It works by using AI-powered algorithms to assess your creditworthiness within minutes based on your profile, credit score, and banking data. Once approved, funds are disbursed directly to your bank account, typically within 24 hours.

Infinz is currently offering its personal loan services all over India, and business loan services only in Bengaluru and around locations within 150 KM.

Your loan eligibility depends on factors like your monthly income, credit score, employment history, and existing obligations. Generally, you can borrow 10-15 times your monthly salary, with loan amounts ranging from ₹10,000 to ₹1 crore. Use our eligibility calculator on the website for an instant assessment of your borrowing capacity.

Basic documents include: PAN Card, Aadhaar Card, salary slips (last 3 months), bank statements (last 3-6 months), employment letter or offer letter, and recent passport-size photographs. Additional documents may be requested based on your employment type and loan amount.

We offer multiple repayment options: Auto-debit from your bank account (recommended), online payment through net banking, UPI payments, and NEFT/RTGS transfers.

You'll receive instant approval notification via SMS and email within a few minutes of application completion. Once all documentation is verified, funds are typically disbursed within 24 hours on business days. You'll get real-time updates throughout the process via SMS and email.

Contact our customer support team immediately if you anticipate payment difficulties. We offer flexible solutions like EMI restructuring, payment holidays, or tenure extension based on your situation. Early communication helps avoid late payment charges and protects your credit score.

You can apply for a new loan immediately after full repayment of your existing loan. In fact, timely repayment makes you eligible for higher loan amounts and better interest rates on future loans. Repeat customers often get instant pre-approved offers.